city of richmond property tax rate

Assessment Methodology Business. Real estate taxes are due on January 14th and June 14th each year.

Hosting Ukrainian Refugees Council Tax Implications

Also for credit card payments there is a 25 convenience fee in addition to the total tax and transaction fees charged.

. County schools it is 12000. 1 the Richmond City Commission has adopted a 415 million budget. 15 Simple DIY Ideas to Boost Your Curb.

Yearly median tax in Richmond City. The City of Richmond assessors office can help you with many of your property tax related issues including. Richmonds real estate tax rate is 120 per 100 of assessed value.

The City of Richmond is located south of Vancouver in the Metro Vancouver Regional District and is home to over 198K residents. 105 of home value. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800.

The tax rate for FY 2021-2022 is 380000 cents per 100 assessed value. Real Estate Tax Frequently Asked Questions FAQs What is the due date of real estate taxes in the City of Richmond. This has also led to property tax rates of 120 per hundred in Richmond while neighboring Henrico County residents pay 085 per hundred.

City of Richmond adopted a tax rate City of Richmond City Hall 402 Morton Street Richmond TX 77469 281 342-5456 Website Design by Granicus - Connecting People and Government. Ahead of the fiscal year with starts Oct. Richmond City has one of the highest median property taxes in the.

Tax bills are mailed out on July 1st and December 1st and are due on September 30th and February. 1 of the next year. Real property is generally land and all the improvements.

With this guide you can learn valuable facts about Richmond property taxes and get a better understanding of things to expect when it is time to pay. June 5 and Dec. Tax Rate per 100 of assessed value Albemarle County 434 296-5856.

These documents are provided in Adobe Acrobat PDF format for printing. Want to know more about Richmond property tax. Richmond City collects on average 105 of a propertys assessed fair market value as property tax.

Property taxes are billed in October of each year but they do not become delinquent until Feb. There is a 150 transaction fee for each payment made online. Any returns filed after May 1 st are assessed a late filing fee of ten dollars 10 or ten percent 10 of the tax assessed whichever is greater.

Town of Richmond 5 Richmond Townhouse Road Wyoming RI 02898 Ph. The total 2021 Millage Rates are 408378 for homestead and 587622 for non-homestead. The City Assessor is responsible for listing and keeping the records for all real and personal property in the City of Richmond.

Whether you are already a resident or just considering moving to Richmond City to live or invest in real estate estimate local property tax. Amelia County 804 561-2158. Property Tax Appraisals The City of Richmond Tax Assessor will appraise.

Learn all about Richmond City real estate tax. If you are considering taking up. Even though higher.

The budget calls for lowering the property tax rate from. Including data such as Valuation Municipal County Rate State and Local Education tax dollar amounts. Skip to main content.

These agencies provide their required tax rates and the City collects the taxes on their behalf. All properties in multi-residential commercial and industrial property classes or subclasses are subject to mandatory capping or clawback adjustments as. What are the property taxes in Richmond NH.

For information and inquiries regarding amounts levied by other taxing authorities please contact. Richmond Property Tax Calculator 2021. The new assessments will be used to calculate tax bills mailed to city property owners next year.

The City Council voted Monday to maintain the real estate tax rate of 120 per 100 of assessed value following a debate over whether to lower it to 1135 to partially offset the tax increase. Check out our guide to how it compares with other locations.

What U S Cities Have The Highest Property Tax Rates Mansion Global

Property Taxes How Much Are They In Different States Across The Us

Ontario Property Tax Rates Lowest And Highest Cities

These 6 Ontario Cities Currently Have The Lowest Property Tax Rates In The Province Ontario City The Province Real Estate Buying

Ontario Property Tax Rates Lowest And Highest Cities

This Ontario Resort For Sale Has 6 Villas Is Like Living On The Mediterranean Sea In 2022 Vacation Living Resort Mediterranean Sea

Here S Where You Ll Pay The Highest And Lowest Property Tax In Ontario Urbanized

Cross Creek Ranch Fort Bend County New Homes Tax Rates Fulshear Fulshear Texas Fort Bend County

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

Service After Sale The Houston Region To All Of My Buyers Request To Correct Name Or Address On A Real Property Accoun Harris County Tax Forms Accounting

Soaring Home Values Mean Higher Property Taxes

These 6 Ontario Cities Currently Have The Lowest Property Tax Rates In The Province Ontario City The Province Real Estate Buying

2353 Millbrook Home Buying Real Estate Kaizen

City Of Richmond Adopts 2022 Budget And Tax Rate

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

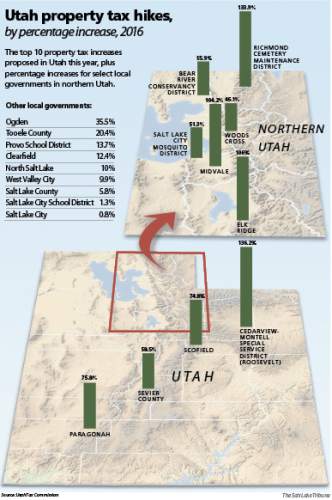

Despite Fuzzy Claims 53 Utah Local Governments Are Proposing Property Tax Hikes The Salt Lake Tribune